Staying invested in the stock market, at times, can be gut-wrenching. Just ask investors in the dot.com bust of 2000-2002, the Great Recession of 2007-2009, or more recently the coronavirus plunge in March of 2020, how they felt during the market freefall. It can be hard to keep focused on the long-term potential of investing versus the short-term pain of “paper losses.” Here are two charts that help provide evidence that staying the course is in your best interest.

While market timing can enhance portfolio performance, it can also lead to significant losses. Investors who attempt to time the market run the risk of missing periods of tremendous returns, leading to significant opportunity loss. The graph below illustrates the risk of trying to time the S&P 500 by showing the effects of missing the one best month on an annual return. And these best one-month periods often come immediately after a dramatic drop, when very few market timers are willing to jump in.

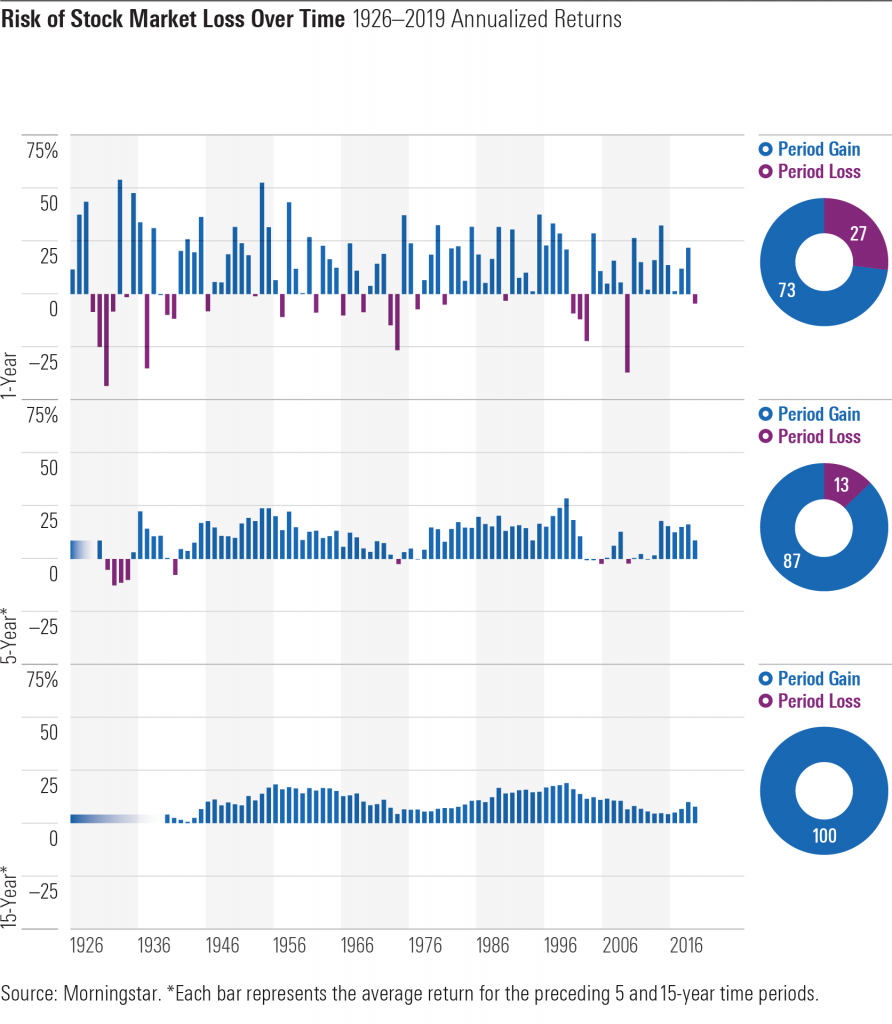

Long-Term Gains Offset Short-Term Losses

The graphs below illustrate the S&P 500 returns for rolling one-, five- and fifteen-year periods. Although stocks are considered risky investments, their long-term gains have been demonstrated to offset short-term losses. Since 1926, the graph shows:

- Of the 94 one-year periods, 25 (27%) have resulted in loss

- Of the 90 rolling five-year periods, only 12 (13%) have resulted in a loss

- Of the 80 rolling fifteen-year periods, none have resulted in a loss

Investing during a market downturn is never fun. Whether putting new capital to work, or remaining invested with existing funds, having an investment strategy for both up and down markets is critical to reaching your long-term financial goals.

If you have any questions, our team is standing by to help. Fill out our contact form, and a team member will be in touch soon.