In deciding when to start Social Security benefits, it is important to understand the basics. This article will address the three key components to determining your Social Security benefit – primary insurance amount, full retirement age, and when you can file for benefits.

Primary Insurance Amount (PIA)

Simply put, your PIA is the amount of your monthly Social Security benefit once you reach full retirement age (see below). The PIA is based on lifetime Social Security covered earnings, adjusted for inflation, using the highest 35 years of earnings. The government then uses a series of calculations to determine the actual PIA. A good explanation of the process can be found here. To obtain your current PIA, you can find your benefit statement at ssa.gov/myaccount.

Full Retirement Age (FRA)

The FRA is the age when you are eligible to begin receiving the entirety of your PIA. Historically, full retirement age occurred in the year you turned 65 for those born prior to 1943. FRA began gradually increasing to 67, starting with people born in 1943 or later.

When Can You File for Benefits?

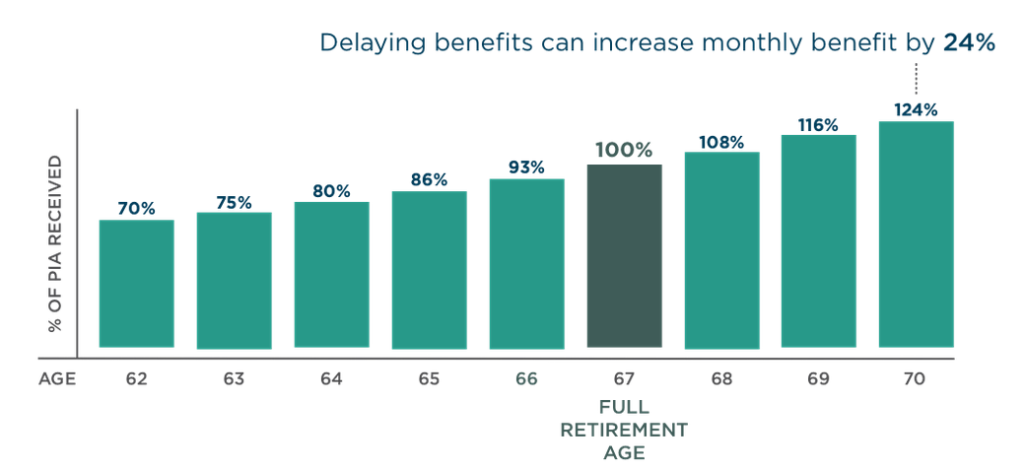

Making the decision to file for Social Security benefits varies based on several personal factors. Your options include early filing (permanently reduced benefits), delayed filing (permanently increased benefits) or opting to file for benefits at FRA. The longer you wait to file (up to age 70), the more your monthly benefit will be. It is important to remember that once you file, your benefit will remain constant (except for increases for Cost-of-Living Adjustments (COLA)). You cannot file and then refile for a higher benefit.

Our next article will examine spousal and family benefits provided by Social Security. If you have questions about Social Security benefits, please contact us. We would be happy to review your situation and work through your options.